The same goes with leverage in finance. The borrowed money can be used to trade or invest in the concerning capital markets. The outcome can be greatly increased with leverage as you will be opening bigger positions with a smaller invested amount. But if things go wrong or not as per expectations, you will face losses on the borrowed amount that also needs to be repaid.

Hence, leverage can be considered as an opportunity to grab significant returns with lower deposits. Although, this opportunity comes along with risk. This guide will assist you with all the details you must possess regarding leverage in trading forex and other capital markets.

Leverage Meaning & Definition

The word leverage originated from mechanics where the applied force gets augmented with the help of a lever. The meaning of leverage is somewhat similar in finance too.

Leverage is a borrowed capital that is used for financing and increases the returns on investment capital. The borrowed capital needs to be repaid but the positive returns generated on the borrowed capital will be yours to keep.

Brokers and liquidity providers allow traders in various capital markets to use leverage in trades for generating higher returns. Some capital markets with high liquidity display minor fluctuations. Deriving gains out of such markets requires significant investment. In such markets, leverage plays an efficient role to garner high returns with smaller investment amounts.

Leverage providers do not lend 100% amount to traders and investors as it won’t be practically possible. To allow feasible borrowing on trades and investment, they offer leverage in a fixed proportion commonly known as the leverage ratio.

Leverage Meaning & Definition

Leverage Ratio in Trading: Explained with Example

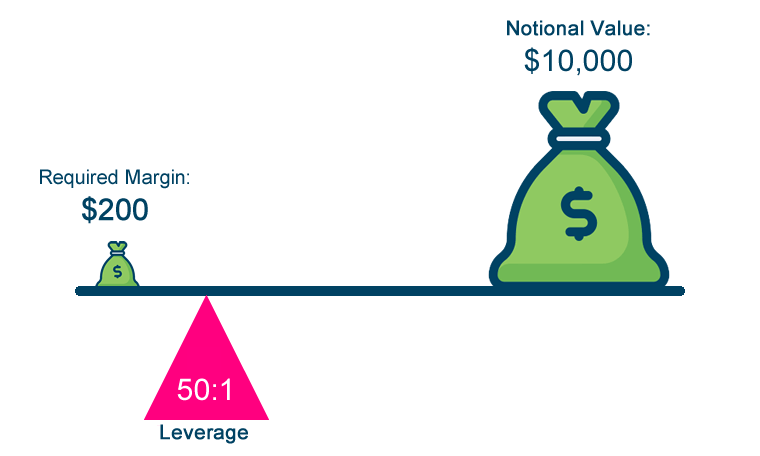

If a trade order is executed with leverage, a portion of the trading amount needs to be paid by the trader. The proportion of borrowed and invested amount depends on the leverage ratio.

A leverage ratio is a financial ratio that indicates the proportion of debt in a trade. A leverage ratio of 1:100 means that 1% of the trading amount will be paid by the trader while 99% will be borrowed from the broker or leverage provider. The proportion of the invested amount that is paid by the trader is called a margin.

The percentage of margin depends on the leverage ratio. Leverage of 1:100 will have a 1% margin requirement, leverage of 1:50 will have a 2% margin.

In forex or other capital markets with minor price movements, leverage plays an important role. It allows traders to book surplus profits without using too much capital.

Example 1: You wish to go long on 1 standard lot of EUR/USD that is currently trading at 1.20500/1.20520 with leverage of 1:500.

1 standard lot has 100,000 units of the quote currency. To buy 100,000 EUR, you need to pay 100,000 * 1.20520 = 120,520 USD without leverage. With the involvement of leverage, buying a standard lot becomes much more feasible as you only need to pay the margin amount i.e. 1/500 = 0.2% of 120,520 USD which is 241.04$.

With the help leverage ratio of 1:500, you were able to open a position on 1 standard lot of EUR/USD with 241.04$. If there was no leverage you needed 120,520$ in your account to open this position. Accordingly, if the leverage ratio was 1:50, the position would be opened with a margin requirement of 2410.4$.

Leverage in Forex

In the example discussed above, it can be observed that leverage can play a very important role in forex trading. Forex traders must know every possible impact of leverage on their trades.

It is essential to trade forex with a decent leverage ratio as high leverage might be lucrative but can increase the risk factor up to a great extent. Excessive leverage in forex trading can lead to unbearable losses if the price moves against the expectation.

The price movements in forex currency pairs are commonly denoted in percentage in points (pips). A movement of 1 pip is the movement of 1 point at the fourth decimal of the concerning currency pair. Suppose if the buy price of EUR/USD moved from 1.2050 to 1.2051, it can be said that the price increased by 1 pip.

The actual price of any currency pair generally moves from 100 to 1000 pips in a day or can be more or less depending on the market conditions. Trading in forex without leverage will lead to significant margin requirements.

Top regulators of forex brokers have implemented restrictions on the maximum leverage that can be offered in forex trading in their respective jurisdictions. In the UK, the maximum leverage that can be offered by the broker is 1:30. The same in the US and Australia is 1:50 and 1:30 respectively. There is no lower cap on the availability of leverage as offering leverage is not mandatory for the brokers.

In most of the Asian and African countries including Nigeria with little or no regulation on forex, there is no set limit for maximum leverage that can be offered. Hence, brokers are free to offer leverage up to any extent. Some brokers even offer leverage ratios of up to 1:2000.

What is the best Leverage Ratio in Forex?

In general, a leverage ratio of 1:100 to 1:200 is considered safe for forex trading. As there is no restriction or upper cap on maximum leverage in Nigeria, many new traders often seek the best leverage ratio in forex. Although, the suitability of the leverage ratio depends on the deposit amount and the risk-taking ability of a trader.

If you have deposited less than 100$ and the leverage ratio is less than 1:100, you won’t be able to open a position of 0.1 lot. However, if the leverage ratio is 1:500, then you might be able to open a position of nearly 0.5 standard lot, thus increasing the opportunity of making profits.

High leverages can be highly advantageous if the trader correctly predicts the price movement. In the opposite case, high leverages can drain out all your deposited amount and if negative balance protection is not available, the balance can also go in negative. Limitations on leverage are implemented for the protection of traders and to maintain liquidity in the market.

Maximum Leverage by Forex and CFD brokers in Nigeria

The table below describes the maximum leverage offered by the well-regulated forex and CFD brokers in Nigeria.

Max Leverage in Nigeria

| Forex Trading platform | Minimum Deposit | Lowest EUR/USD Spread | Regulation(s) | Max. Leverage | Available Instruments | Visit |

|---|---|---|---|---|---|---|

|

Minimum Deposit: $5

|

Lowest EUR/USD spread*: 1.2 pips

|

Regulation(s): FCA, FSCA, CySEC

|

Max. Leverage:

1:1000 |

Available instruments: 49 currency pairs, and 200+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.9 pips

|

Regulation(s): FSCA, ASIC, CySEC

|

Max. Leverage:

1:400 |

Available instruments: 55 currency pairs, 1000+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $5

|

Lowest EUR/USD spread*: 0.8 pips

|

Regulation(s): ASIC, CySEC

|

Max. Leverage:

1:888 |

Available instruments: 57+ currency pairs, 1000+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $10

|

Lowest EUR/USD spread*: 1.9 pips

|

Regulation(s): FCA, FSCA, CySEC

|

Max. Leverage:

1:500 |

Available instruments: 59 currency pairs, and 200+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.6 pips

|

Regulation(s): FCA, CySEC

|

Max. Leverage:

1:30 |

Available instruments: 71 currency pairs, and 2000+ CFDs

|

Visit Broker |