Bitcoin trading has taken the world by storm due to phenomenal gains booked by traders in recent years. The capital market of cryptocurrencies has increased manifold signaling a significant involvement of traders worldwide.

Nigerian traders have always been major participants in bitcoin and cryptocurrency trading. The spike in cryptocurrency valuation in recent years has generated remarkable gains for bitcoin traders in Nigeria. However, it is never too late to start bitcoin trading.

Since transactions to and from cryptocurrency wallets and crypto trading apps are banned in Nigeria, we have covered the legal bitcoin CFD trading more extensively in this guide.

If you have little or no idea about bitcoin trading or cryptocurrency trading in Nigeria, this guide will provide you with all the details required to start your money-making journey in bitcoin trading.

What is Bitcoin?

Bitcoin is the oldest cryptocurrency in the world launched in late 2008. For those wondering ‘what is Cryptocurrency?’ it is a digital or virtual currency that only exists on the internet. Cryptocurrencies are decentralized networks that are secured by cryptography. In simple words, it is a digital asset that exists on a network divided over multiple computers around the globe.

Cryptocurrencies are not governed by any government or financial authority of the world which makes them risky as well as valuable. There are more than 9000 cryptocurrencies in the world. Many of them are copies of major cryptocurrencies like bitcoin, ethereum, etc.

Bitcoin being the oldest, is also the most valuable cryptocurrency in the world. The value of 1 bitcoin in July 2010 was nearly 0.0008$ which dramatically increased in upcoming years to breach the 64,000$ mark in April 2021. The current market capitalization of bitcoin is more than 1 trillion USD.

Bitcoin has displayed exceptional price movements over the years to reach this all-time high. Due to frequent price movements, it is a lucrative avenue for high-risk traders and speculators all around the world.

2 Methods to Trade Bitcoin in Nigeria

Bitcoin or any other cryptocurrency can be traded in Nigeria mainly through 2 methods.

- Bitcoin Trading Through Crypto Wallets and Crypto Trading Apps

The first method to trade bitcoin is by directly buying and selling the cryptocurrencies to book profits through trading apps or crypto wallets. Traders need to buy at low and sell at high in order to generate positive outcomes. By this method, traders will hold actual cryptocurrencies after buying them through any of the available crypto trading applications in Nigeria.

- Bitcoin trading through CFDs

The second method to trade bitcoins or any other cryptocurrency is through Contract for Differences (CFDs) in which the price movement is speculated to book profits without owning any bitcoins. Various foreign regulated CFD brokers offer cryptocurrency trading services through CFD in Nigeria. By trading bitcoins through CFDs, traders can go long as well short on the price without owning any bitcoins.

- Traders get to hold actual bitcoins after buying.

- Traders can hold bitcoins for a long term without additional cost

- Bitcoins can be transferred or used as a payment method to a third party

- Ideal for long term speculation

- Bitcoin transactions through local banks are banned in Nigeria.

- Bank accounts can be frozen by CBN if found transacting through crypto wallets

- The commission is charged for each trade order

- Traders cannot go short on bitcoins without owning any

- Not regulated by any government or financial authority of the world

- No leverage is available for trading through crypto wallets

- Only cryptocurrencies can be traded

- No restrictions on bank deposits and withdrawal through regulated CFD broker

- Traders can go long as well as short without owning any bitcoins

- Multiple top tier foreign regulated CFD brokers are available in Nigeria

- Availability of leverage allows traders to book higher profits

- Customer support service is available

- Traders can also trade with forex and CFDs on other instruments with a single account

- CFD trading includes spreads that can change due to market conditions

- High leverage in bitcoin CFD trading can increase the risk factor

- Traders do not own bitcoin but speculate price movement

- Extra charges might incur if a position is kept open for long tenure

- Not ideal for long term speculation

- Safety: The safety of the trader depends on the regulation and background of the broker. The bitcoin CFD trading app must be regulated by a top-tier foreign regulatory authority as these brokers are not regulated in Nigeria. The top-tier regulatory authorities include FCA, FSCA, ASIC, and CySEC. Apart from regulations, traders should also seek for the history, owners, and any disputes raised in the past against the broker.

- Fees: Each bitcoin CFD broker charges different trading and non-trading fees that can greatly affect the outcomes of a trade. The trading fees include spreads and commission for executing trade orders. The non-trading fees involve all the charges that are incurred without trading i.e. account opening fees, deposit/withdrawal fees, inactivity fees, currency conversion fees, etc. Traders must check and compare all the visible and hidden charges before opening an account with a regulated CFD broker.

- Account Types: Many brokers offer multiple account types to suit different types of traders. Some accounts can be ideal for beginners or low volume traders while others might be good for experienced or high volume traders. The deposit requirements, trading platforms, fees, leverage, and many other features can differ on the basis of account types.

- Support: Some of the bitcoin CFD brokers in Nigeria having local offices in Nigeria provide local phone support while others only offer live chat support. Traders must choose a CFD broker offering user-friendly and resourceful support services for a better trading experience.

- Trading Platforms: The trading platforms offered by the CFD broker must be available on mobile and PC with all the required features and fast execution. MT4 and MT5 are the commonly offered trading platform by the bitcoin CFD brokers but some may also offer other platforms.

Is Bitcoin Trading Legal in Nigeria?

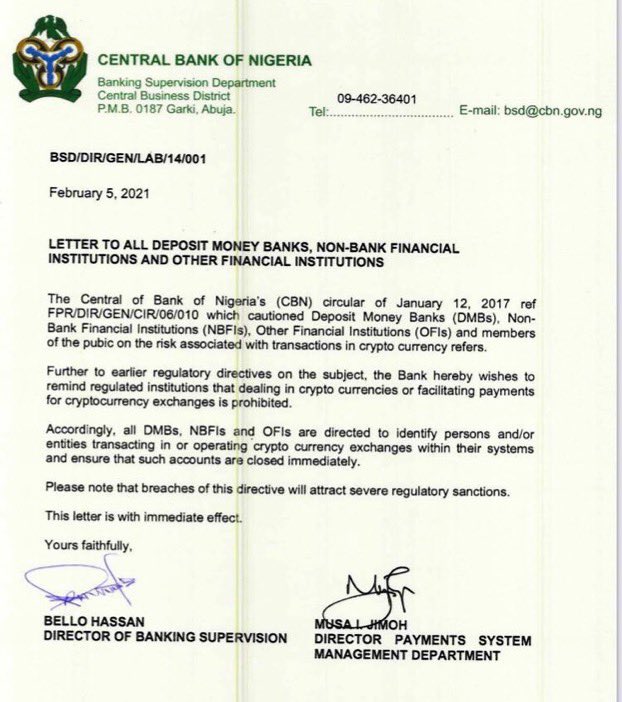

Before 2021, Nigeria was among the largest bitcoin trading markets in the world. However, on 5th Feb 2021, the Central Bank of Nigeria (CBN) imposed limitations on bitcoin trading by restricting transactions from local banks in Nigeria.

The CBN instructed all the private as well as government banks in Nigeria to close all the accounts involved in the direct buying and selling of bitcoins through crypto wallets or crypto trading apps.

However, there is no ban or restrictions on bitcoin trading through CFDs in Nigeria if the CFD broker is regulated by a foreign regulatory authority. After the imposition of a ban on cryptocurrency transactions, many traders have shifted towards regulated CFD brokers for bitcoin trading in Nigeria.

Pros and Cons of Bitcoin Trading Methods

Both the methods of bitcoin trading in Nigeria have pros and cons. Although, the benefits of trading bitcoins through CFDS are far more superior to trading bitcoins through wallets or crypto trading apps.

Bitcoin Trading Through Crypto Wallets and Crypto Trading Apps in Nigeria

Pros

Cons

Bitcoin Trading Through CFDs in Nigeria

Pros

Cons

What is Bitcoin CFD Trading?

After the ban on cryptocurrency transactions through bank accounts in Nigeria, CFD trading on bitcoins is a legal method to trade cryptos through regulated CFD brokers. A CFD or Contract for Difference is a contract through which traders can speculate the price movements of bitcoin or other instruments without owning them.

Bitcoin CFD is a derivative to trade cryptocurrencies in which traders can open a position to go long as well as short. It includes a spread that is the difference between the buy price and sell price of the concerning asset under CFD. The spreads can widen or narrow depending upon the market conditions.

Various top-tier regulated international brokers offer CFD trading in Nigeria. Each broker can offer different spreads, transaction methods, support services, and trading conditions for bitcoin trading in Nigeria. Hence, the selection of brokers can play a vital role in the trading experience of bitcoin CFDs.

How to Select a Bitcoin CFD Trading App or Broker?

Each regulated broker that offers CFD trading on bitcoin and other assets can have different features to offer to the client. Potential bitcoin traders must make adequate efforts to search for the best-suited broker to have a pleasant and rewarding trading experience. The following factors should be kept in consideration while selecting a CFD broker in Nigeria.

Apart from the above-mentioned factors, various other aspects need to be considered for a better trading experience. These factors include educational tools, research & analysis tools, available trading instruments, bonus offerings, etc. Availability of local office in Nigeria and Naira-based trading account can be an added advantage for Nigerian bitcoin CFD traders.

How to Trade Bitcoin CFD?

CFD trading is a convenient and user-friendly method to trade an underlying instrument. Bitcoin CFD trades can be executed through any of the regulated CFD brokers with the following steps.

Step 1: Open an account

The account needs to be created and verified at a regulated broker. It is better to check the above-mentioned factors while selecting a CFD broker. Make sure it offers CFD on bitcoin.

Step 2: Make a Deposit

After opening the account and KYC process, you can deposit through any of the methods supported by the broker.

Step 3: Login Trading App

The next step is to download and login into the trading app offered by the broker. Trading apps like MT4/MT5 are available on various devices.

Step 4: Open the BTC/USD window

BTC/USD is the commonly traded bitcoin pair. Traders can also trade with BTC/EUR, BTC/GBP, etc.

Step 5: Select the lot size

In general, the lot size on bitcoin CFDs is 1 BTC per lot. Although, it can differ from broker to broker. Traders can select a minimum lot size of 0.01.

Step 6: Go long or short

The CFD trading on bitcoins allows traders to go long as well as short without owning any bitcoins. If you buy, you

are hoping for an increase in price while if you sell, the profit will be earned if the price goes down.

Step 7: Close the position to book profits

After opening the trade, you will be able to see movements under the profit/loss section according to the price movement of bitcoin. The figure under profit/loss will be your booked profit or loss from the trade.

What are the Best Bitcoin CFD Trading Apps in Nigeria?

To reduce your efforts of checking and comparing each regulated broker in Nigeria, we have selected a few trustworthy brokers that offer quality bitcoin CFD trading services in Nigeria. Following are the best CFD brokers in Nigeria that can be chosen for bitcoin trading.

| Forex Trading platform | Minimum Deposit | Lowest BTC/USD Spread | Regulation(s) | Max Bitcoin CFD Leverage | Lot Size | Visit |

|---|---|---|---|---|---|---|

|

Minimum Deposit: $5

|

Lowest BTC/USD spread*: 26 USD

|

Regulation(s): FCA, FSCA, CySEC

|

Max Leverage:

1:10 |

lot size 1 Bitcoin

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 45 USD

|

Regulation(s): FSCA, ASIC, CySEC

|

Max. Leverage:

1:20 |

Available instruments: 10 Bitcoins

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 54 USD

|

Regulation(s): CySEC

|

Max. Leverage:

1:10 |

Available instruments: 1 Bitcoin

|

Visit Broker | |

|

Minimum Deposit: $10

|

Lowest EUR/USD spread*: 60 USD

|

Regulation(s): FCA, FSCA, CySEC

|

Max. Leverage:

1:10 |

Available instruments: 1 Bitcoin

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 148 USD

|

Regulation(s): FCA, CySEC

|

Max. Leverage:

1:2 |

Available instruments: 1 Bitcoin

|

Visit Broker |

How Risky is Bitcoin Trading?

Most of the cryptocurrencies including bitcoin are considered very risky due to dramatic price movements. The price can change due to a plethora of reasons and the markets are open 24*7 in every corner of the world. Hence, it can be quite risky to track or predict the price movement of bitcoin.

Bitcoin is an ideal trading instrument for high-risk and experienced CFD traders. Those who are new or looking to start trading bitcoin CFDs must use a demo account before a live account to check suitability and learn the basics of CFD trading.